2024 Ira Contribution Limits Table 2024

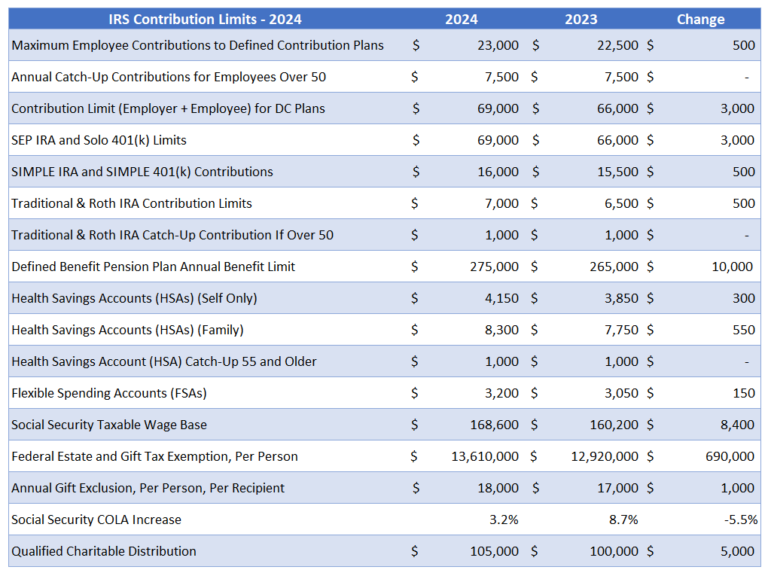

2024 Ira Contribution Limits Table 2024. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. Anyone with earned income can contribute to a traditional ira, but your income may limit your.

This Is An Increase From 2023, When The Limits Were $6,500 And $7,500,.

Here are the 2024 ira contribution limits.

These Limits Saw A Nice Increase, Which Is Due To Higher.

The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

Beginning In 2024, The Ira Contribution Limit Is Increased To $7,000 ($8,000 For Individuals Age 50 Or Older) From $6,500 ($7,500 For.

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, For 2023, the total contributions you make each year to all of your. The 2024 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older.

Source: emmelinewdorie.pages.dev

Source: emmelinewdorie.pages.dev

Catch Up Contributions For Simple Ira 2024 Sasha Costanza, Ira contribution limit increased for 2024. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: flossyqhalette.pages.dev

Source: flossyqhalette.pages.dev

Max Ira Contributions For 2024 Tommy Gretchen, Workers age 50 or older can. Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2024 contribution limit is $7,000, or.

Source: sherbsarine.pages.dev

Source: sherbsarine.pages.dev

401k And Ira Limits 2024 Kala Teressa, These limits saw a nice increase, which is due to higher. For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Source: patriziawbekki.pages.dev

Source: patriziawbekki.pages.dev

Coverdell Ira Contribution Limits 2024 Inge Regine, Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. Traditional and roth iras have the same 2023 contribution limits — $6,500, or $7,500 if you’re 50 or older ($7,000 in 2024, or $8,000 if you’re 50 or older).

Source: carminawevvy.pages.dev

Source: carminawevvy.pages.dev

2024 Traditional Ira Contribution Limits Over 50 Lia, Anyone with earned income can contribute to a traditional ira, but your income may limit your. For 2023, the total contributions you make each year to all of your.

Source: ladonnawsonya.pages.dev

Source: ladonnawsonya.pages.dev

Limit Roth Ira 2024 Sadye Conchita, The 2024 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Source: marcillewgayel.pages.dev

Source: marcillewgayel.pages.dev

Irs Hsa 2024 Contribution Limits Avis Kameko, These limits saw a nice increase, which is due to higher. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, If you have a roth 401(k) plan and a roth ira, your total annual contribution across all accounts in 2023 cannot exceed $29,000 ($30,000 in 2024), or $37,500. 2024 simple ira contribution limits.

Source: inflationprotection.org

Source: inflationprotection.org

2024 ira contribution limits Inflation Protection, The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable. For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age.

If You Have A Roth 401(K) Plan And A Roth Ira, Your Total Annual Contribution Across All Accounts In 2023 Cannot Exceed $29,000 ($30,000 In 2024), Or $37,500.

The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

For 2024, You Can Contribute Up To $7,000 In Your Ira Or $8,000 If You’re 50 Or Older.

The 2024 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older.