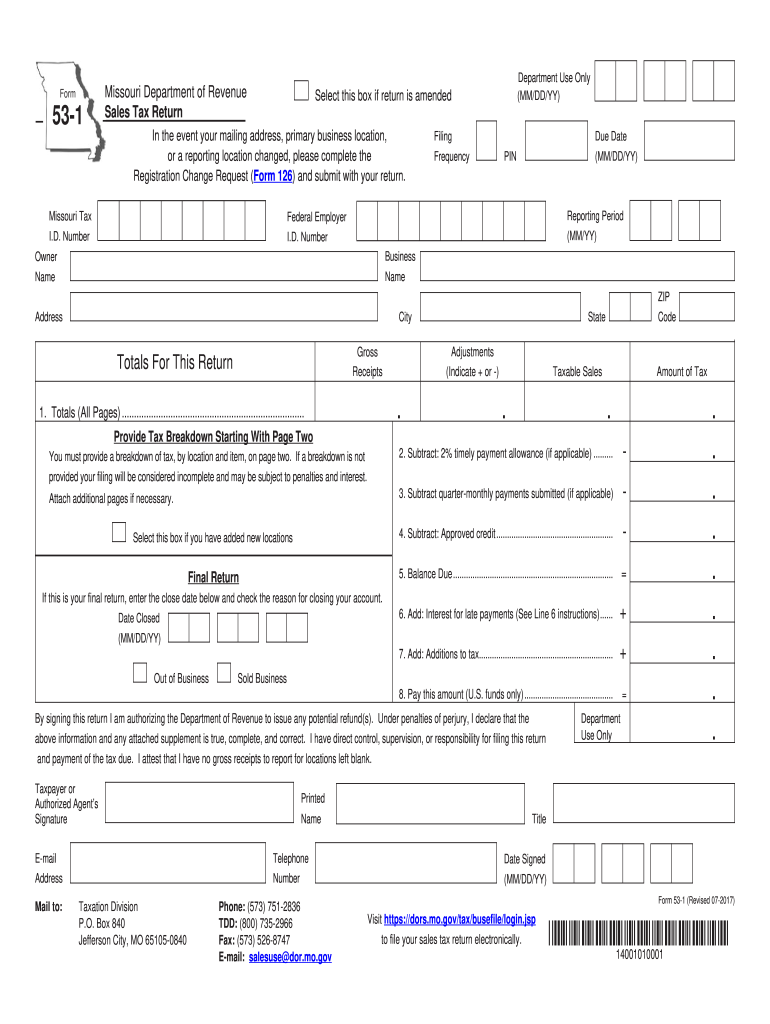

Missouri Tax Form 2025

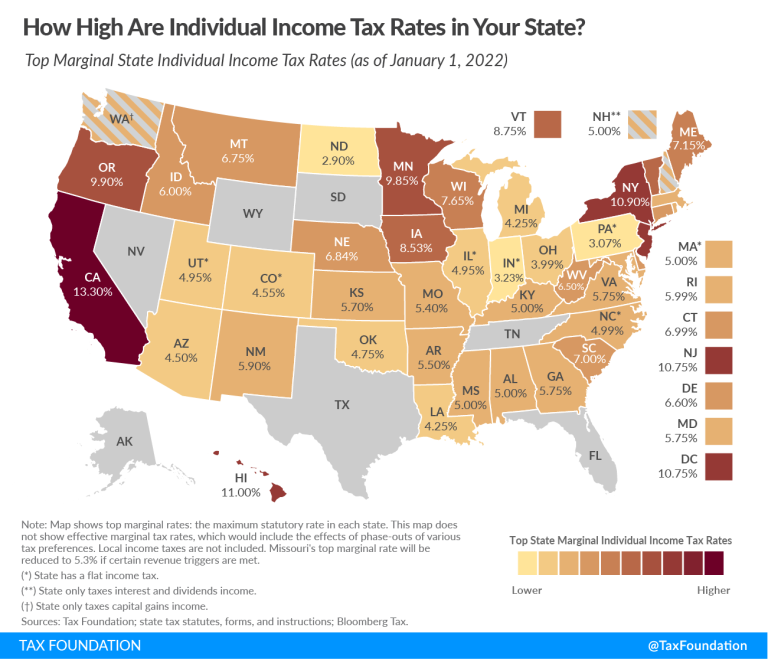

Missouri Tax Form 2025. If you make $70,000 a year living in missouri you will be taxed $10,498. The missouri tax calculator is updated for the 2025/25 tax year.

Social security (6.2%) medicare (1.45% to 2.35%) the exact percentage of your paycheck that goes to taxes will vary based on your income, filing. For earnings between $1,121.00 and.

Missouri Tax Form 2025 Images References :

Source: berthaqconsolata.pages.dev

Source: berthaqconsolata.pages.dev

Stone County Mo Tax Sale 2025 Barrie Miguela, Top income tax rate to decrease from 5.3% to 4.95% in 2023, with another possible reduction scheduled for 2025 ;

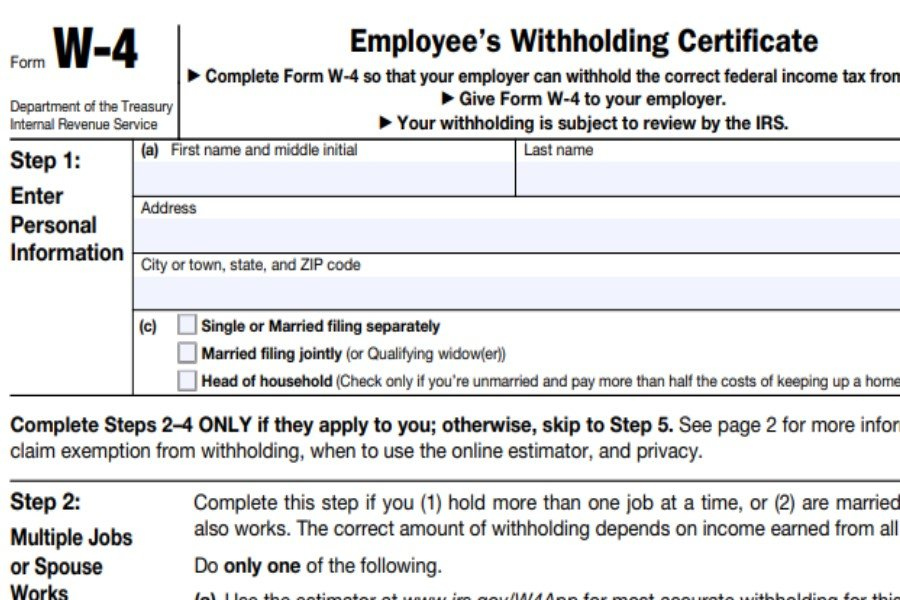

Source: daraheather.pages.dev

Source: daraheather.pages.dev

Sense A2024 Tax Forms Amelia Corinne, For earnings between $1,121.00 and.

Source: nicolbatlante.pages.dev

Source: nicolbatlante.pages.dev

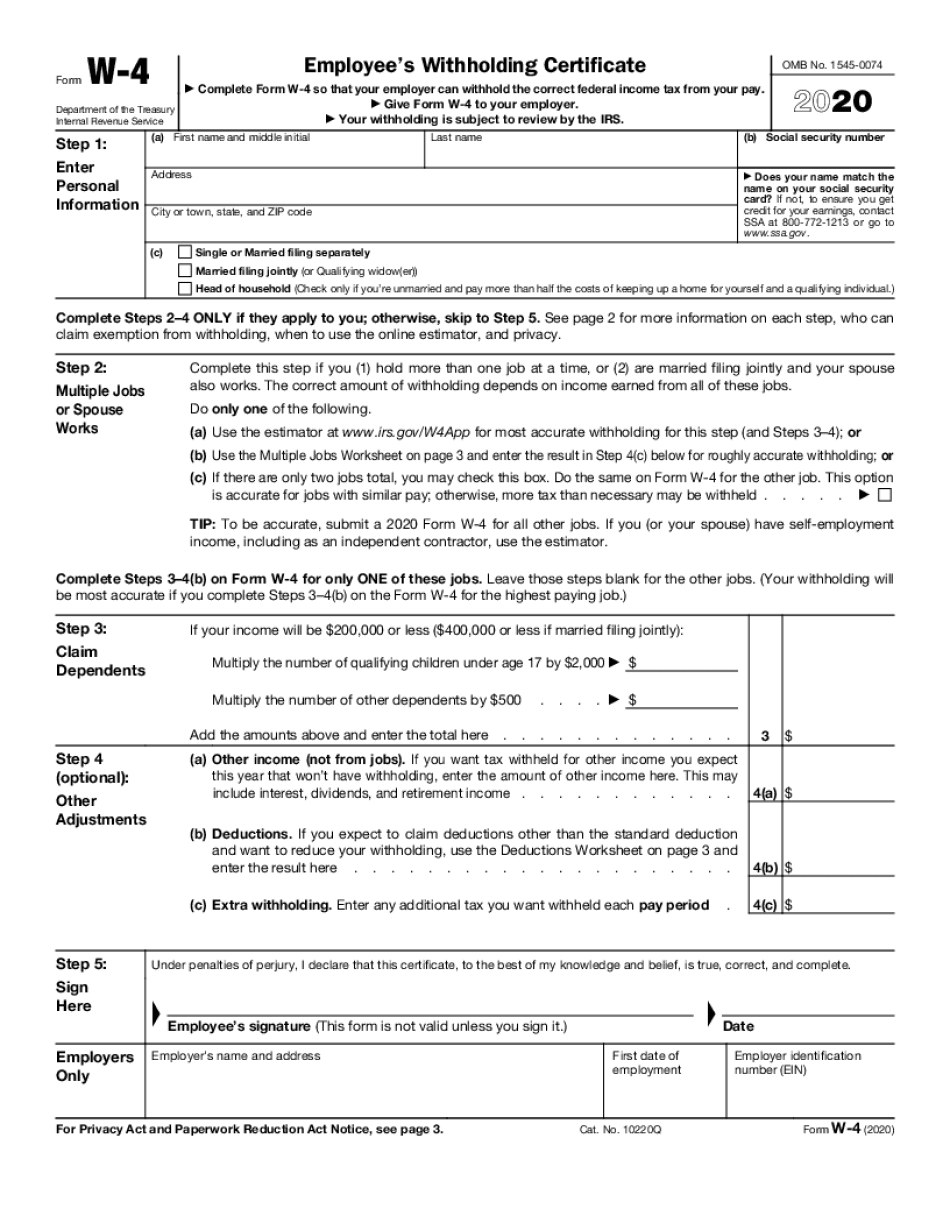

Mo 2025 W4 Form Myrta Tuesday, For earnings between $1,121.00 and.

Source: mandiphillida.pages.dev

Source: mandiphillida.pages.dev

2025 W 4 Missouri Dione Benedikta, Fund analysis (september 2022) message from the director fy 2025 budget instructions examples tax credit analysis form example fund.

Source: elizabcorabel.pages.dev

Source: elizabcorabel.pages.dev

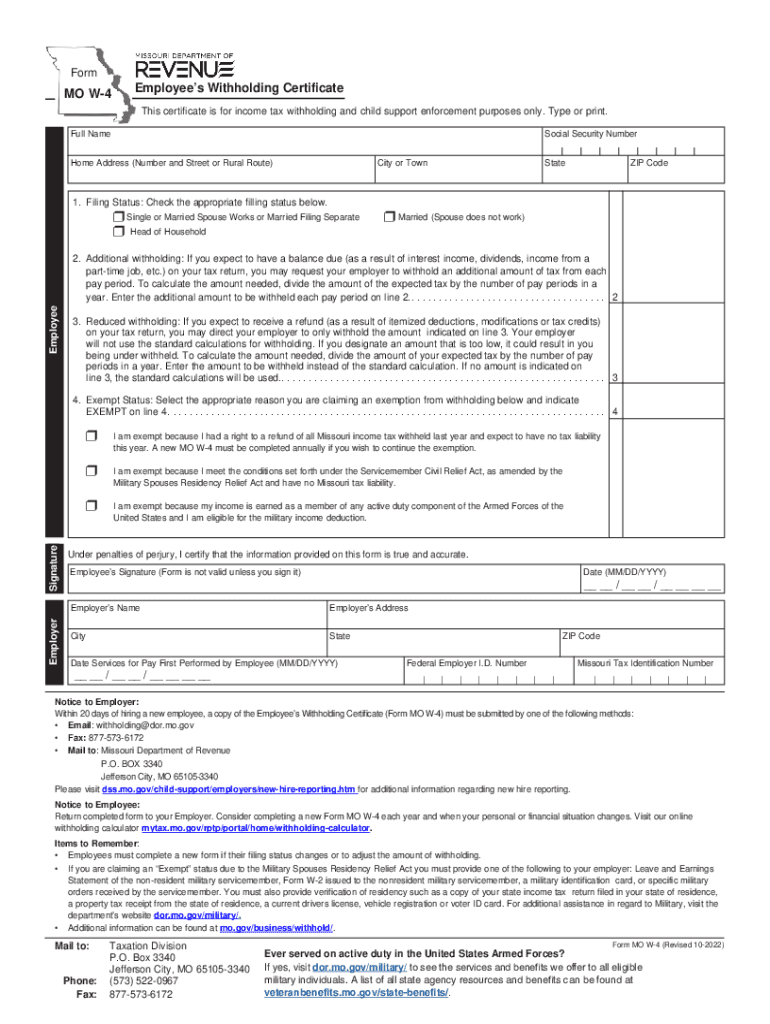

Mo W4 2025 Printable Kelci Melinda, For motor fuel tax paid july 1, 2023 through june 30, 2025 claim must be postmarked july 1, 2025 through september 30, 2025.

Source: corikorney.pages.dev

Source: corikorney.pages.dev

Mo W4 2025 Printable Cathy, Missouri’s income tax rates decreased in its 2025 withholding formula, which was released nov.

Source: gwennymarice.pages.dev

Source: gwennymarice.pages.dev

Alabama Tax Free Holiday 2025 Jorry Joella, Married filing jointly tax brackets.

Source: tanayothilie.pages.dev

Source: tanayothilie.pages.dev

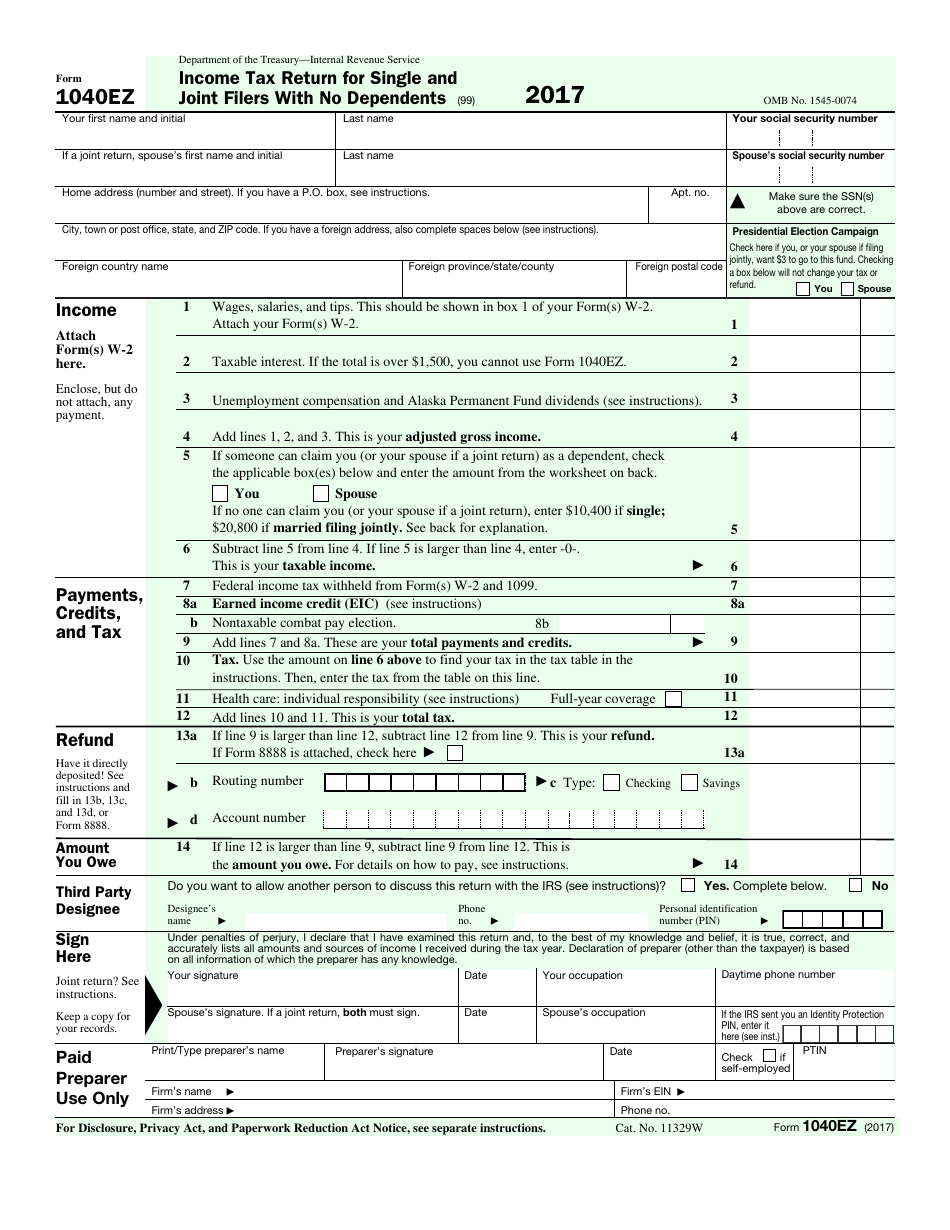

2025 2025 Tax Form Printable Nikki Stephie, The federal standard deduction for a married (joint) filer in 2025 is $ 29,200.00.

Source: rayjasmine.pages.dev

Source: rayjasmine.pages.dev

2025 Tax Forms 2025 Sr 2025 Form Tobey Augustina, Federal married (joint) filer tax tables.

Source: alfyqsibelle.pages.dev

Source: alfyqsibelle.pages.dev

2025 W4 Changes Betsey Mellicent, For motor fuel tax paid july 1, 2023 through june 30, 2025 claim must be postmarked july 1, 2025 through september 30, 2025.

Category: 2025